Introduction

As a hurricane approaches land there is always significant uncertainty around what the impact will be on individual portfolios, businesses and the industry overall. Being able to rapidly estimate the range of potential impact of the event and articulate the uncertainty associated, the current forecast helps insurers like Vave to prepare, inform stakeholders, and set appropriate reserves.

When writing a hurricane exposed portfolio, having a well-refined methodology for loss estimation from hurricanes helps to provide stakeholders with the information they need to quickly act on insight given the range of potential losses we expect to experience.

Since 2020, Vave has built out a largely automated methodology which puts insights into the hands of those who need it in quick time, from live exposure data and the latest views on event hazard and uncertainty.

Exposure

Vave hosts live exposure data with EigenRisk using their API suite to upload data on a daily basis to the EigenPrism platform. This gives certainty around the exposure in force at the time of landfall and ability to quickly visualize localised distribution of exposure.

Hazard and uncertainty

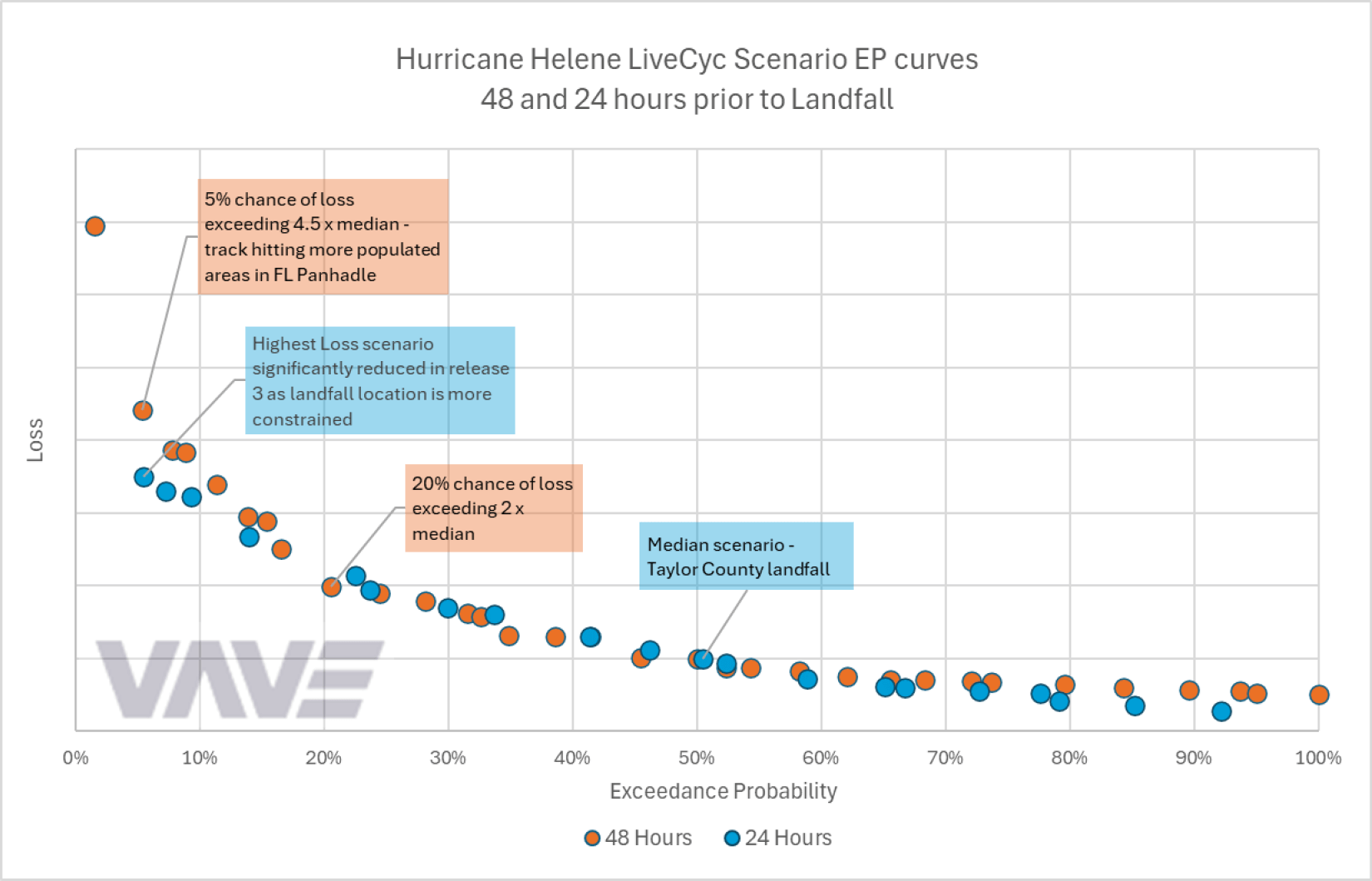

Ahead of an event making landfall, Vave uses ensembles of potential windspeed event footprints derived from the latest NHC forecasts. Using the Reask LiveCyc product allows us to provide a probabilistic set of potential outcomes and visualize in detail what changes to the forecast track or intensity would mean to the outcome for our portfolios.

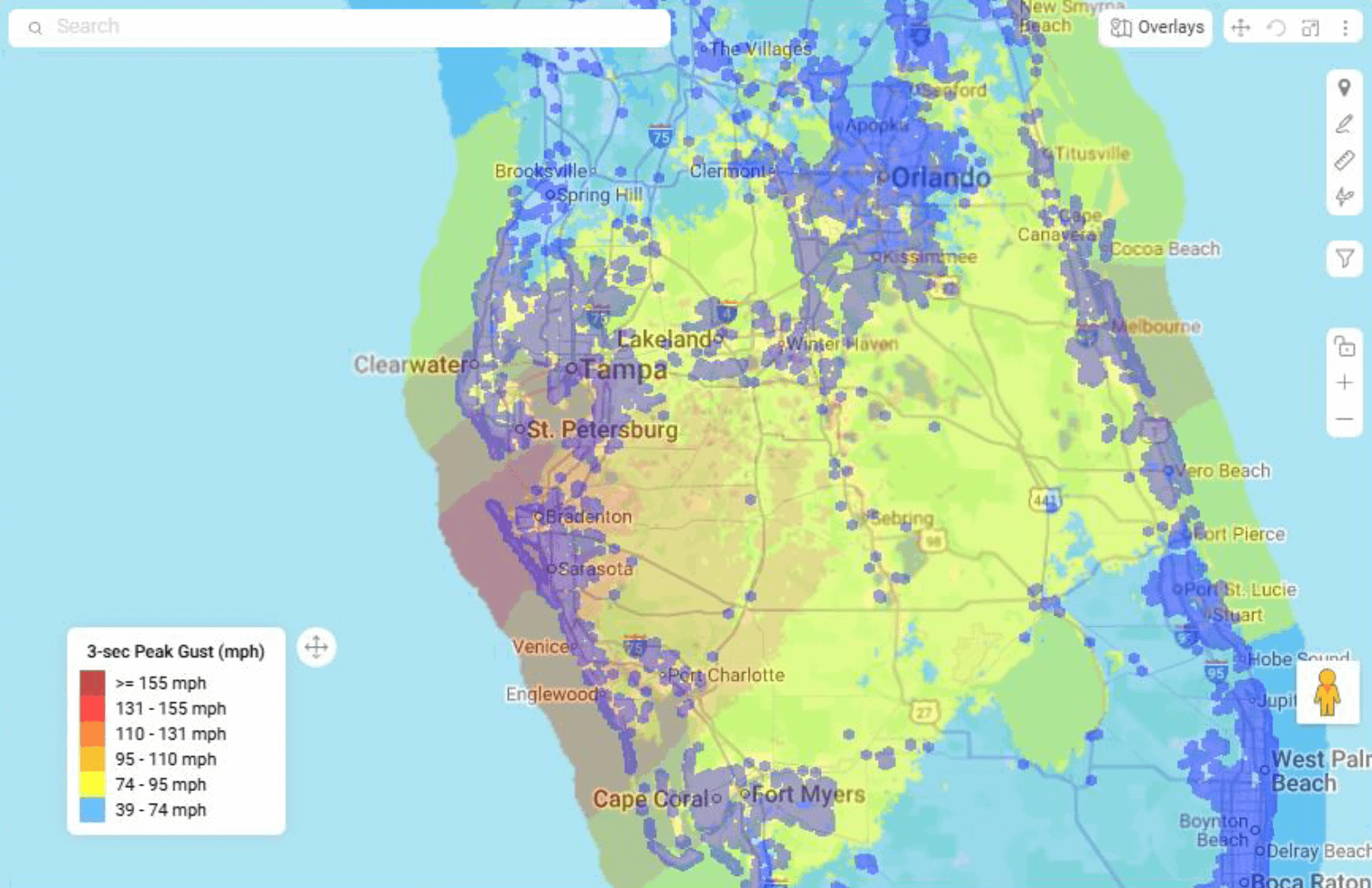

Immediately after landfall, the Reask Metryc product provides high-resolution, surface-level, peak-gust footprints from which hazard intensities can be attributed to each exposure location in the exposed portfolio.

From this, a quick analysis can be made to show the exposure within each level of hazard intensity; this can be quickly compared to prior event experience to give a high-level indication of where the level of loss might sit against historical experience.

Loss estimation

Vave builds custom damage functions relating hazard to losses from historical exposure and claims data to estimate the claims frequency and conditional damage ratio that we might expect to see for a particular wind speed.

These damage functions are applied to the locations exposed to the event to project an initial estimate of loss.

Typically, Vave will look to estimate a range of possible outcomes which address the uncertainty we understand to be inherent in each event and the various components of the loss calculations. For example, in Hurricanes Helene and Milton estimates of the benefits of Florida legislative reforms were applied as a range and the estimates of storm surge leakage were applied to the portfolio based on forecast and observed storm surge depth footprints

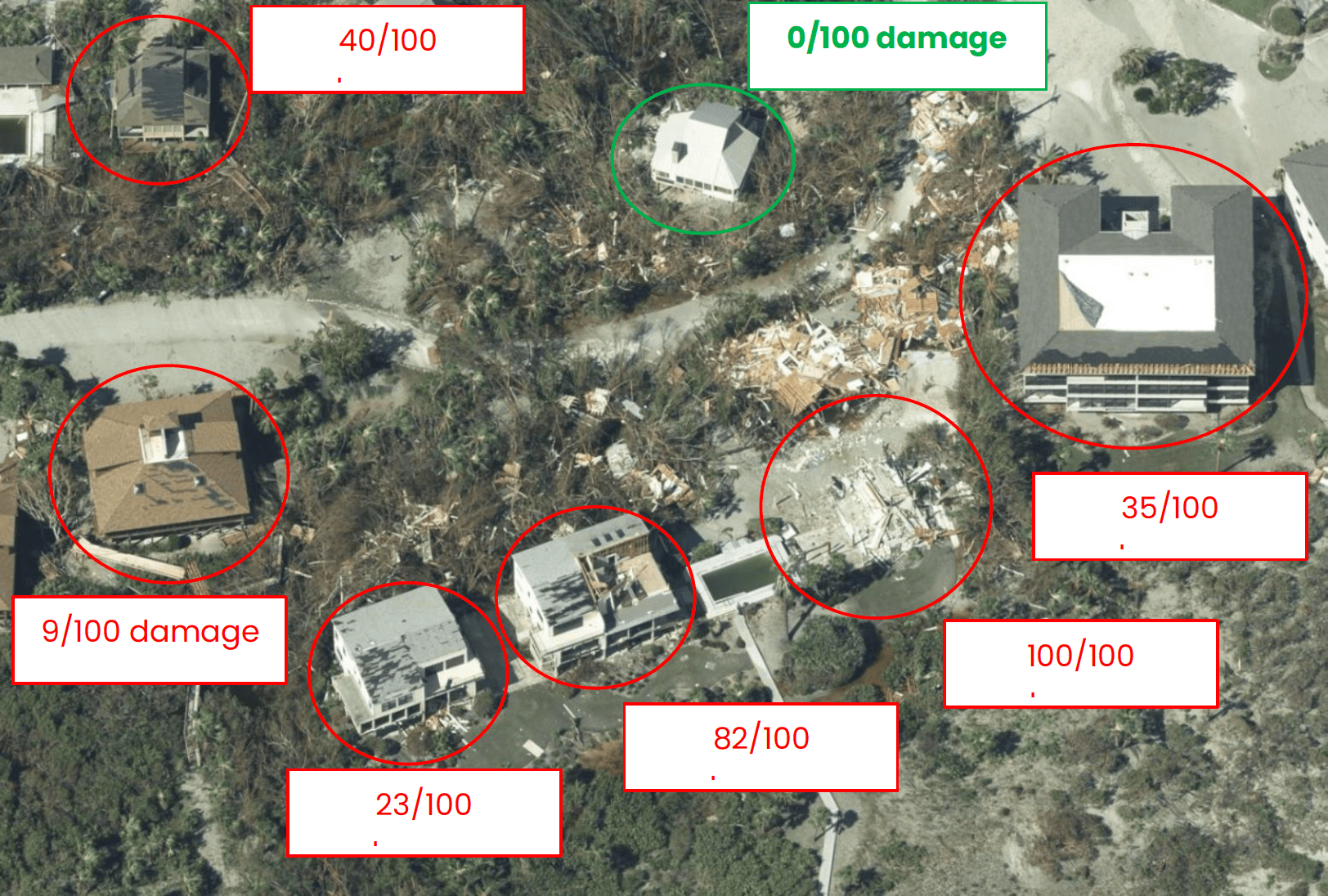

Grey sky location level damage estimation

For areas impacted by the highest intensity wind speeds, Vave looks to the latest aerial ‘grey sky’ imagery which can give deeper insight to observable damage in areas which may remain inaccessible for some time after the event. Remote sensing technology company Vexcel provides very high resolution grey sky imagery and location level damage assessment computer vision AI models, which allow Vave to look at the distribution of observable damage on properties in the Vave portfolio, thus allowing us to check and refine our estimates of claim frequency and damage ratios which can feedback into refining our loss estimation.

Claims tracking

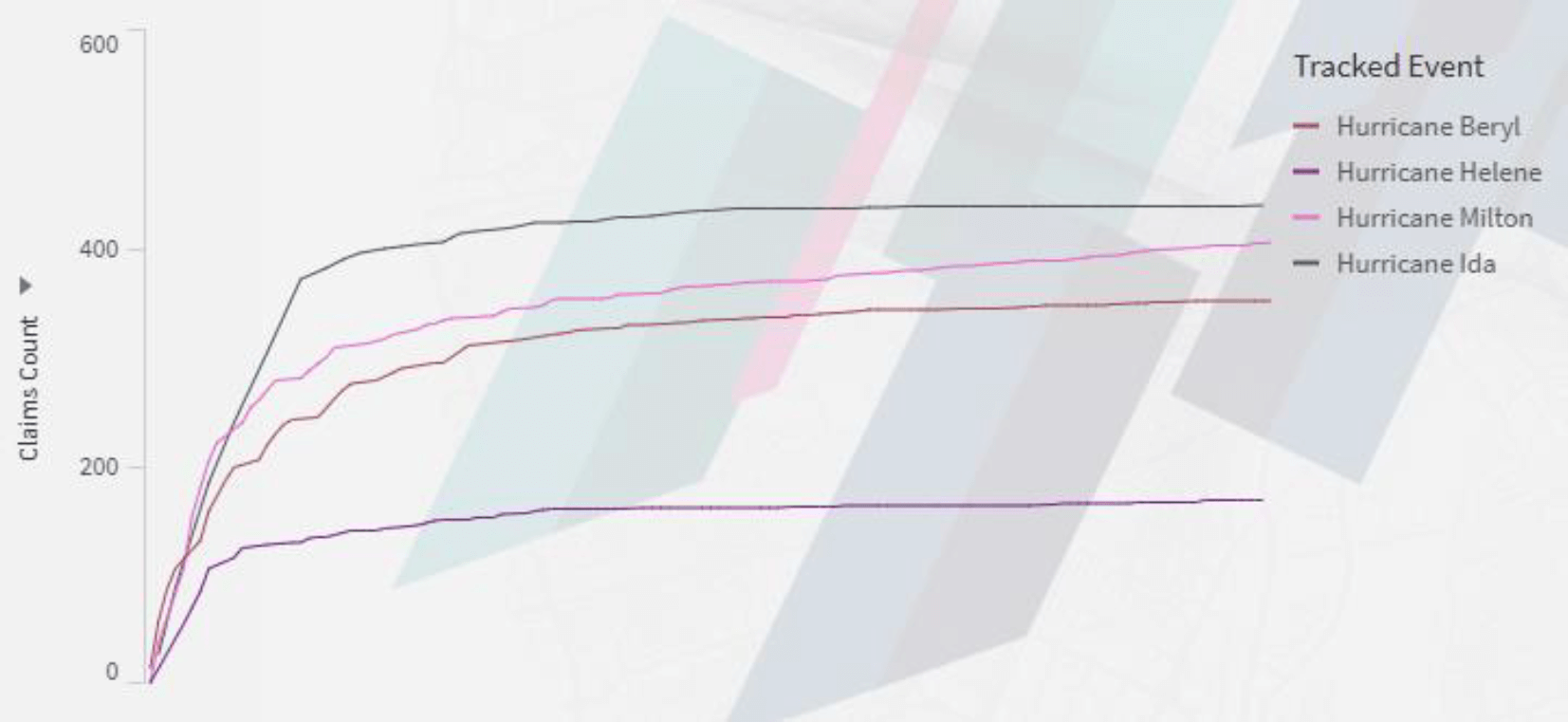

Vave ingests claims data from our TPA partners on a daily basis and automatically links these claims to the exposure in force at the time of loss.

As early claims trickle in we can easily compare our claims frequency to our expectations of the event and compare to our event history, so we can quickly identify if our loss experience from a particular event is in line with our expectations and experience from prior events and whether any changes to the vulnerability functions are appropriate given the data we have seen.

As claims are adjusted and settled, Vave’s approach to aligning exposure, hazard, and claims data allows us to refine our view of hurricane risk and make subsequent adjustments to pricing at a detailed level where actual performance has deviated from our expectations.

Conclusion

Vave’s data-led approach to estimating potential outcomes, leveraging advanced data and technologies from our partners, and continuously refining loss estimations through real-time claims tracking enhances our accuracy and agility. This approach not only refines our loss estimations but also helps iteratively improve pricing strategies, ensuring we remain adaptive and resilient in the face of hurricane events.